What is FinOps? Linking Cloud Costs to Business Outcomes

In recent years, the rise of cloud computing has revolutionized the way organizations operate, providing unprecedented flexibility and scalability. However, the transition from CapEx to OppEx investments in technology has also brought considerable financial challenges, highlighting the critical need for an effective approach to cost management in cloud environments. In this context, the central concept of FinOps emerges: a constantly evolving framework aimed at optimizing financial management in this new technological paradigm.

This article sheds light on FinOps, providing a clear understanding of what it is, why it was created, its importance in today’s business landscape, and tips on its implementation.

The imperative of FinOps

Before the cloud computing era, implementing new solutions required a complex and time consuming process. Development and Engineering teams had to request servers to the procurement department, which then acquired the infrastructure. During that time, it was common for the demand to change and when the servers were bought, they might not be the ideal ones anymore. Finally, the infrastructure team had to configure the operating system, security policies, networking, and give access to the development team. Although this allowed for a high degree of control over costs, the result was often a considerable slowdown in the innovation process.

The rise of cloud computing flipped this model on its head. Teams can now quickly set up infrastructure and experiment with new solutions, accelerating innovation. However, this freedom often led to unchecked spending and reduced visibility into costs. The FinOps concept was created to address this issue by fostering a partnership between tech and finance teams to manage cloud expenses effectively.

What is the definition of FinOps?

The FinOps Foundation describes FinOps as “an operational framework and cultural practice which maximizes the business value of cloud, enables timely data-driven decision making, and creates financial accountability through collaboration between engineering, finance, and business teams.” (Learn more about the FinOps definition) FinOps, therefore, is an organizational practice that aims to ensure that companies are using their cloud resources efficiently and effectively.

In summary, FinOps helps organizations:

- Bring financial accountability in the variable cost model in the cloud;

- Enable distributed IT, finance, and business synchronization for agility, costs, and quality;

- Allocate technology costs linked to the generation of business value for the organization.

An Electricity Bill Analogy

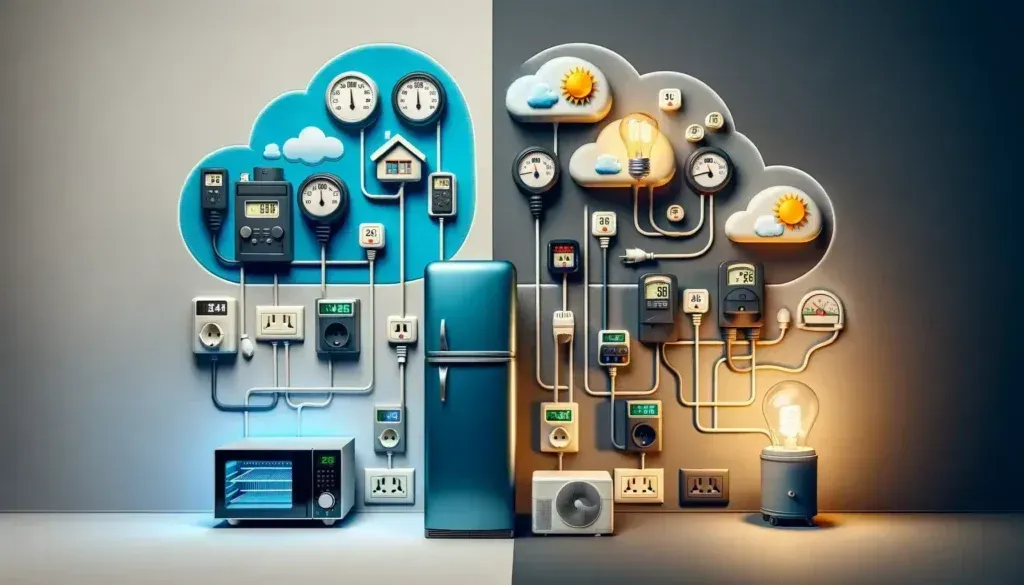

By definition, Cloud Computing is the on-demand availability of computer system resources without direct active management by the user. With that in mind, we can draw a connection to how we consume electricity: it’s (almost) always available, there is a huge network of cables that takes care of getting electricity to us, and at the end of the month, we pay only for what we’ve used, with no need for upfront payments or commitment.

In the context of our electricity usage, some services are essential (like refrigerators), justifying their expense. Others (like microwaves) save time and money. Even non-essential services (like TV) can offer benefits in certain scenarios, such as entertainment that isn’t crucial for our survival, and small, unnecessary expenses (like leaving lights on) can add up. Choosing which cloud services to use is similar to selecting which appliances to plug in, considering their return on investment. We can decide that it is worth turning on the AC on a hot day because we have an important meeting and need a good night’s sleep, for example. It’s always about trade-offs and return on investments.

LET'S CONNECT

Ready to unlock your team's potential?

e-Core

We combine global expertise with emerging technologies to help companies like yours create innovative digital products, modernize technology platforms, and improve efficiency in digital operations.